The primary financial statements of any business include the Balance Sheet, the Profit and Loss, and the Statement of Cash Flow. Together, they represent the total financial picture of a business. They must be reviewed as a set because collectively, they tell you about your business, both in the short term and the long term. They are a means of conveying to management and interested outsides a concise picture of the profitability and financial position of the business. They are used by managers, owners, and investors to get a complete picture of the health of a business.

The Balance Sheet

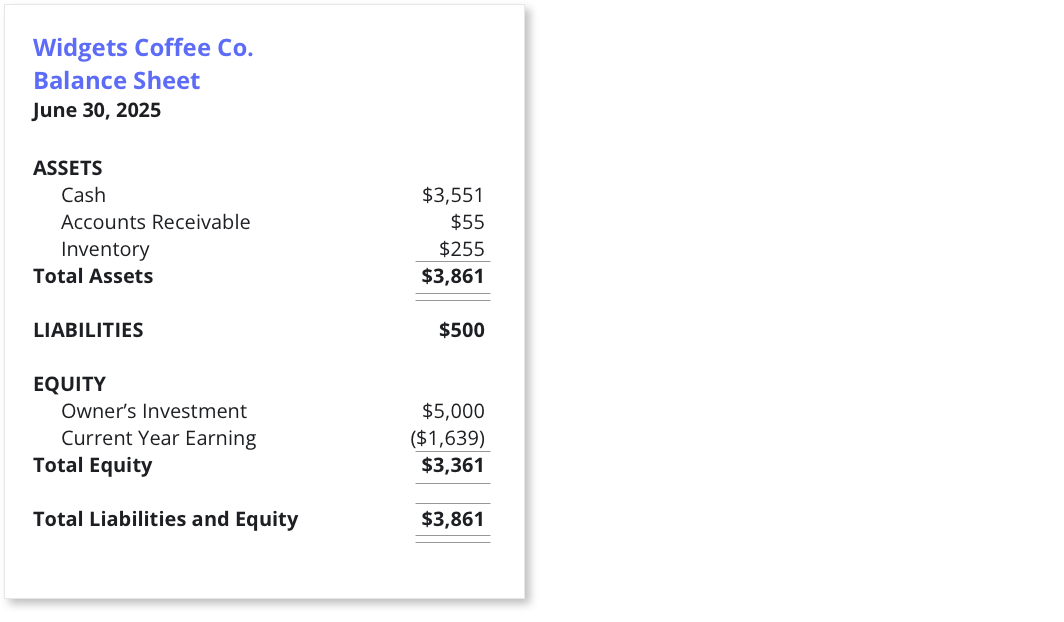

The Balance Sheet displays your total assets (the things you own), less total liabilities (the things you owe), and the difference as owner’s equity. The balance sheet reflects a ‘point in time’ in the life of the business. Typically, you would run a Balance Sheet monthly, quarterly and at year-end. It is a snapshot of your business that would reflect all the account balances “as of” a specific date accumulated since the inception of the business.

A business owner would use a Balance Sheet to understand how the assets of a business are being utilized to service debt and grow capital. It is an excellent way to track performance and show the creditworthiness of the business. It can also be used to calculate financial ratios to help understand the health of the business.

The Profit and Loss Statement (or Income Statement)

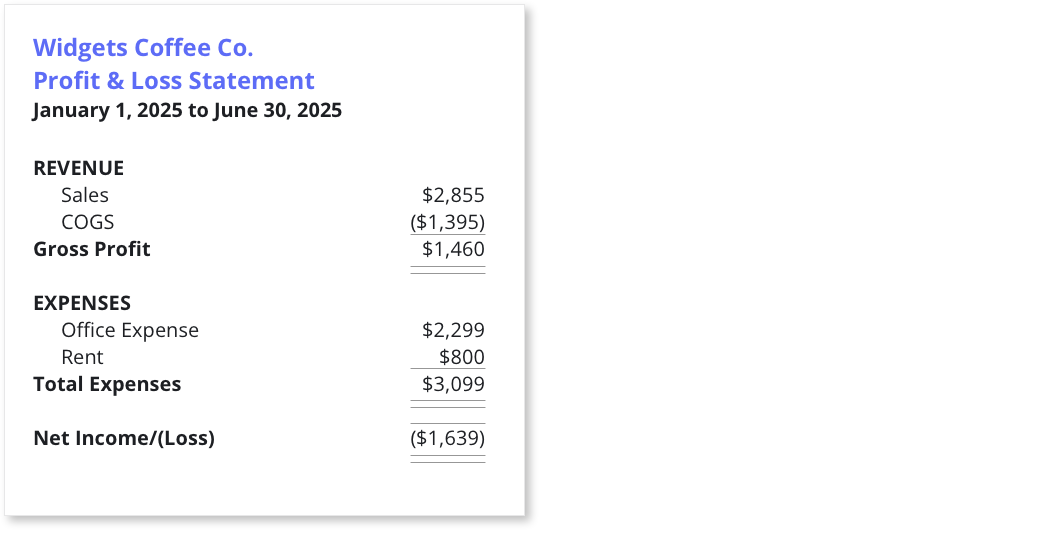

The Profit and Loss reflects your total revenue generated, less the cost of goods and services sold (which equals your Gross Profit), less your operating expenses (fixed and overhead), which equals your Net Income or Loss. The profit and loss reflect results for a ‘period of time’: for example, January 1, 20xx, through December 31, 20xx. It summarizes the revenue generated and costs incurred to generate those revenues. This report is ‘closed’ annually, with the net income or loss moved over the balance sheet and added to the retained earnings of the business. It is run monthly, quarterly, and annually, along with the balance sheet and represents the primary financial statements.

The Equity section of your Balance Sheet typically includes an account called “Current Year Earnings,” which represents the fiscal year-to-date net income or loss of your business. Your business’s life-to-date history of profit and losses is recorded in the Retained Earnings account. At the close of every year, the Current Year Earnings accounting is rolled into (or closed into) the Retained Earnings account. Each year, your Profit and Loss information is closed into your Retained Earnings account, which is how the Balance Sheet and the Profit and Loss report are tied together.

It is important to remember that a Balance Sheet represents a point in time while a Profit and Loss represents a period of time.

The Cash Flow Statement

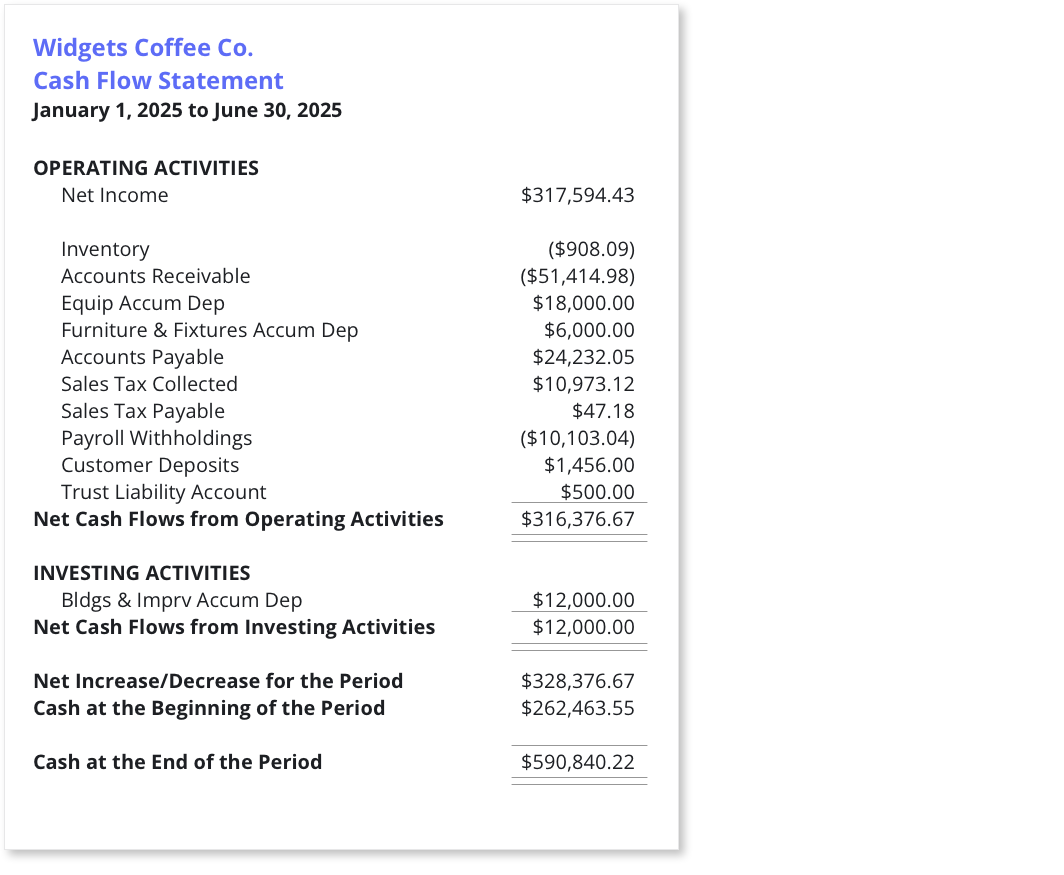

Oftentimes, your accountant will prepare a third financial report called the Cash Flow Statement or the Statement of Changes in Financial Position. It shows how much cash a business has generated and spent over a period of time. It includes the opening cash balance and the change in cash for a period (the sources and uses), resulting in the ending cash balance. It is a good measure of how well a company is doing, generating enough cash flow to pay its bills. The main purpose of the statement is to help explain the significant investing and financial activities of a company during a period of time.

Key Takeaways

- The three core financial statements of any business of any size are the Balance Sheet, the Profit and Loss Statement, and the Cash Flow Statement.

- The Balance Sheet shows the balances of the assets, liabilities, and owner’s equity of a business as of a point in time.

- The Profit and Loss represents the total revenue generated by a business, less its cost of goods sold and overhead expenses.

- The Cash Flow Statement represents the sources and uses of cash and helps determine if a business is generating enough revenue to cover its expenses.

Manage Your Financials With AccountEdge

Managing your cash flow probably keeps you up at night. AccountEdge will keep track of money in and money out, connect to your bank for faster reconciliation, and provide reports to help you make better decisions.